The Role of Broker Liability in Commercial Truck Accidents

The Role of Broker Liability in Commercial Truck Accidents

When a Commercial Truck Accident happens, the impact can be devastating. Lives are changed, families are torn apart, and entire communities feel the effects. At Raymon Law Group, we know the causes of these crashes often go beyond a driver’s mistake. The decisions made by freight brokers before a truck ever hits the road can play an equally important, if not greater role.

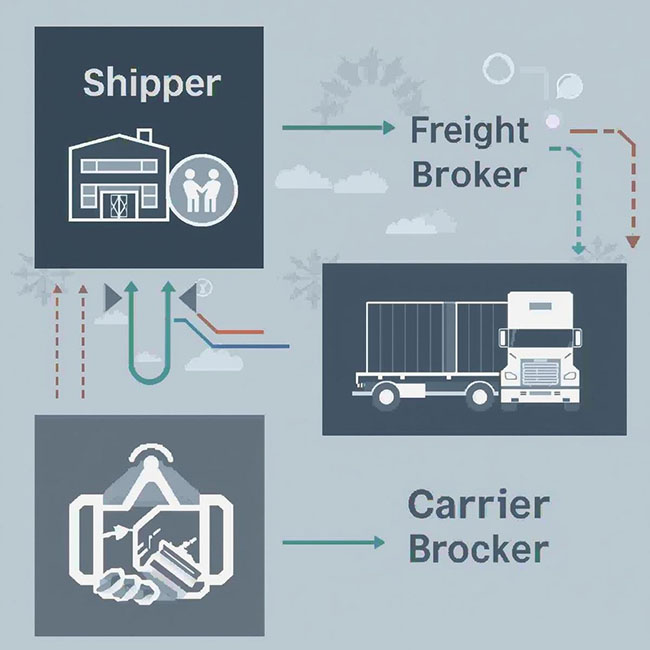

Freight Brokers: What They Do & Where Liability Emerges

A freight broker is someone who arranges for goods to be hauled, connecting shippers (people or companies who need goods transported) with carriers (trucking companies or independent drivers). The broker does not typically drive the truck or maintain the equipment. Their responsibility lies in choosing which carrier to hire, negotiating rates, and facilitating the contract.

Liability arises when brokers fail in their duty to ensure that the carrier they select:

holds proper licenses

maintains required insurance coverage

has a history of acceptable safety performance (e.g., fewer or no serious FMCSA violations)

uses drivers who meet regulatory standards

If a broker hires a carrier with known safety issues such as prior accidents caused by fatigue, poor maintenance, or violations of hours-of-service rules and that carrier causes a crash, then broker liability becomes relevant under both federal and New Mexico state law.

Legal Foundations in New Mexico and at the Federal Level

Negligence in Carrier Selection

Under New Mexico tort law, one who negligently places someone in harm’s way is responsible. If a broker selects a carrier who is unfit, that selection may itself be a negligent act.

Federal Regulations (FMCSA)

The Federal Motor Carrier Safety Administration requires that brokers ensure carriers are properly registered, licensed, insured, and in compliance with safety regulations. Brokers are expected to do due diligence. Failure to verify these can lead to liability.

Comparative Fault and Joint Liability

Even when a truck driver or carrier is directly at fault, brokers may share liability. New Mexico follows comparative negligence rules, which means that even if a plaintiff bears some responsibility, they may still recover, reduced by their share of fault.

Wrongful Death & Damages Law

For fatal accidents, New Mexico law allows survivors to pursue wrongful death claims. Broker liability can significantly increase the pool from which damages are drawn, particularly where the carrier’s insurance is inadequate, but the broker has deeper liability or resources.

Statistical Picture: New Mexico & National Trends

National Crash Facts

- According to NHTSA’s Traffic Safety Fact – Large Trucks (2023), there were 5,472 people killed in traffic crashes involving large trucks in 2023.

- Of those fatalities, about 70% were occupants of other vehicles, not the large truck itself.

- Nationwide, large‐truck involved injury crashes numbered in the hundreds of thousands annually.

New Mexico Workplace Injury & Fatality Data

- According to the Bureau of Labor Statistics (New Mexico region), transportation incidents are the leading cause of fatal occupational injuries in New Mexico. In 2023, a large share of work‐related deaths was from transportation.

- For 2022, New Mexico had 57 fatal occupational injuries; 31 of those were transportation related.

- Also, non‐fatal injuries and illnesses in private industry in New Mexico are numerous: in 2022, there were approximately 12,400 recordable cases, with 6,700 being more severe (days away from work or restriction).

How Broker Negligence Manifests in Real Cases

From our experience, some typical situations where broker liability becomes a central issue include:

- Broker contracts with a carrier who consistently fails inspections or has a poor FMCSA safety rating

- Broker is aware (or should have been aware) of prior serious crashes or OOS (out‐of‐service) orders, but still hires the carrier because their bid was low

- Broker does not verify that the carrier has adequate liability and cargo insurance

- Broker’s contract fails to include necessary safety or maintenance assurances, or fails to audit carrier performance

- Broker pressures carrier to speed up delivery schedules, indirectly encouraging hours‐of‐service violations

Why Broker Liability Matters for Victims

There are practical reasons why identifying broker liability is essential for injured people and families:

- Insurance Coverage: Carrier insurance is often minimal. Brokers may carry larger policies, or multiple layers of coverage. Identifying brokers as liable parties opens up access to more resources for compensation.

- Accountability: Brokers often exert influence on how carriers operate (routes, load scheduling, carrier choice). When brokers behave irresponsibly, justice demands they be held to account.

- Complex Claims: Without broker liability, plaintiffs may be left with limited defendants with limited assets. Including brokers often allows more complete compensation.

- Punitive Effect: Especially egregious behaviour by brokers (e.g., hiring carriers in spite of known safety violations) may warrant higher settlement or damage awards as a deterrent.

Investigating Broker Liability: What We Do at Raymon Law Group

In every serious commercial truck accident case, we launch a multi‐pronged investigation, because in many cases, the truth of broker involvement is hidden in contracts, records, or regulatory filings. Key steps include:

Safety History Review: Examining FMCSA databases for carrier’s inspection history, crashes, out‐of‐service orders.

Contract Analysis: Getting hold of the shipping contract, broker‐carrier agreement, and invoices to see what safety representations were made.

Insurance Verification: Checking what insurance the carrier and broker had, what coverage was promised, and if promise was kept.

Communications Audit: Reviewing emails, bids, dispatch records, logs that may show broker pressured carrier, ignored warnings, or was aware of deficits.

Regulatory Compliance: Verifying whether the carrier had valid licensing, driver qualification, maintenance records, and whether broker checked these.

PERSONAL Injury Lawyer New Mexico

Challenges in Proving Broker Liability

Contracts may be hidden or difficult to obtain.

Brokers sometimes use intermediaries or third‐party contracts that obscure who had responsibility for safety.

Insurance loopholes.

Some brokers may claim that the carrier was an independent contractor, distancing themselves from direct control.

Causation issues.

Plaintiffs need to show that broker’s decisions contributed materially to the crash, not just indirectly. E.g., that had the broker vetted carriers properly or not chosen a high‐risk one, the accident could have been avoided.

Discovery battles.

Brokers often have strong legal teams that resist disclosure of internal records (emails, safety audits, carrier vetting, etc.).

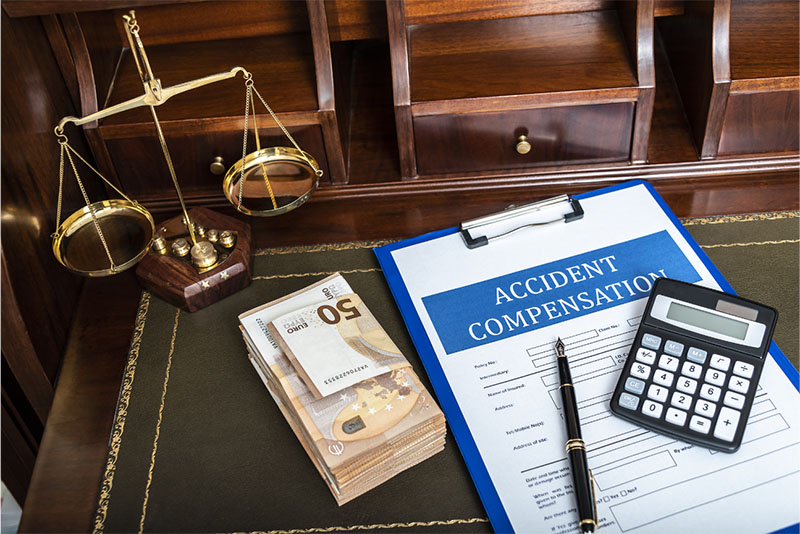

Typical Damages in Broker‐Liability Cases

When broker liability is proven, victims may recover:

- Medical bills (short‐term and long‐term)

- Rehabilitation costs, physical therapy, prosthetics, etc.

- Lost wages and reduced ability to earn a living in the future

- Pain, suffering, emotional distress

- Property damage (vehicles, cargo, personal effects)

- Wrongful death damages in fatal incidents (funeral and burial, loss of companionship)

- Punitive or exemplary damages in rare cases where the broker’s conduct was especially reckless or intentional

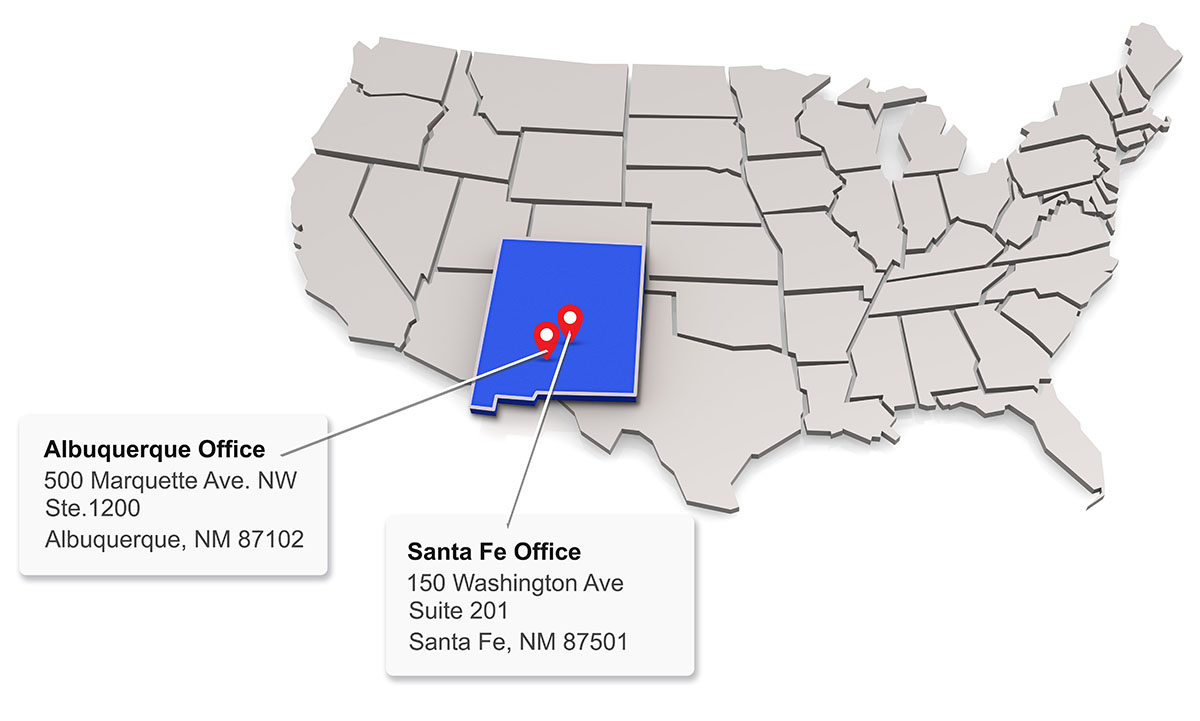

Location Served

We Represent

Individuals & Families

throughout New Mexico

Raymon Law Group’s Albuquerque personal injury lawyers are based at our main office in the heart of downtown Albuquerque at 500 Marquette Ave. NW, Ste. 1200.

We also have our Office at Santa Fe located at 150 Washington Ave, Suite 201. If you’re unable to visit us, our attorneys are happy to meet you at your home or hospital to discuss your case.

Ready to Find the Best Personal Injury Lawyer in New Mexico?

Commercial truck accidents in New Mexico are rarely simple, and broker liability can be the key to securing full justice. Holding brokers accountable ensures that victims are not left struggling with limited compensation while those who cut corners escape responsibility.

At Raymon Law Group, we know how to uncover broker negligence, fight insurers, and demand fair results in the courtroom. If you or a loved one has been harmed in a truck accident, call us at (505) 390-1040. We are ready to protect your rights, hold every negligent party accountable, and fight for the compensation you deserve.